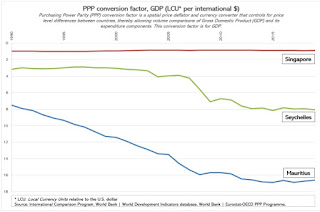

Further rupee depreciation will make it even harder to reinvent Mauritius

To stay pertinent to the reality of similarly open and small economies such as Singapore, Estonia and Hong Kong, may the following sink in:

Firstly;

"Evidence shows that depreciation does not significantly improve exports, but that exchange rate risk significantly impedes exports. In sum, policy makers can better promote export growth by stabilizing the exchange rate rather than generating its depreciation".

Then;

"In the presence of high import content (like in the case of Mauritius), exports are not adversely affected by currency appreciation because the lower import prices due to appreciation reduce the cost of export production".

Last but not least, let us listen to competitiveness guru Michael Porter;

"Devaluation causes a nation to take a collective pay cut. Exports based on low labour and a cheap currency, then, do not support an attractive standard of living.

The central challenge is how to create the conditions for productivity growth. Productivity depends both on the value of a nation's products and services, measured by the prices they can command in open markets, and the efficiency with which they can be produced".

Ultimately, the choice is whether to allow the rupee to be permanently tainted by narrow private interests or to solidly anchor it as one of the prerequisites to building the momentum for balanced and sustainable socio-economic expansion.

Firstly;

"Evidence shows that depreciation does not significantly improve exports, but that exchange rate risk significantly impedes exports. In sum, policy makers can better promote export growth by stabilizing the exchange rate rather than generating its depreciation".

Then;

"In the presence of high import content (like in the case of Mauritius), exports are not adversely affected by currency appreciation because the lower import prices due to appreciation reduce the cost of export production".

Last but not least, let us listen to competitiveness guru Michael Porter;

"Devaluation causes a nation to take a collective pay cut. Exports based on low labour and a cheap currency, then, do not support an attractive standard of living.

The central challenge is how to create the conditions for productivity growth. Productivity depends both on the value of a nation's products and services, measured by the prices they can command in open markets, and the efficiency with which they can be produced".

Ultimately, the choice is whether to allow the rupee to be permanently tainted by narrow private interests or to solidly anchor it as one of the prerequisites to building the momentum for balanced and sustainable socio-economic expansion.

Comments

Post a Comment

Moris Zindabad! is served by various contributors all allergic to bs and simple-minded binaries. The comment board strictly welcomes on-topic thoughts.